Nothing is more expensive than free money

Kevin Walsh, Fed Governor

In Income Matters 4 we laid out our views on the current backdrop. Much has changed in the last few months with some important implications for capital markets.

Many of the trends to which we have become accustomed are in the process of changing. This slow-moving reordering of economies and markets is perhaps most obviously demonstrated by the return of inflation and the very rapid increase in interest rates. Ex-Federal Reserve Board member Jeremy Stein famously observed that interest rates are powerful because “they get in all the cracks”. What he meant was that there are few things in markets and economies that are not influenced by the price of money. Be it immediate, or over time, the probable end of the era of free money is a big change.

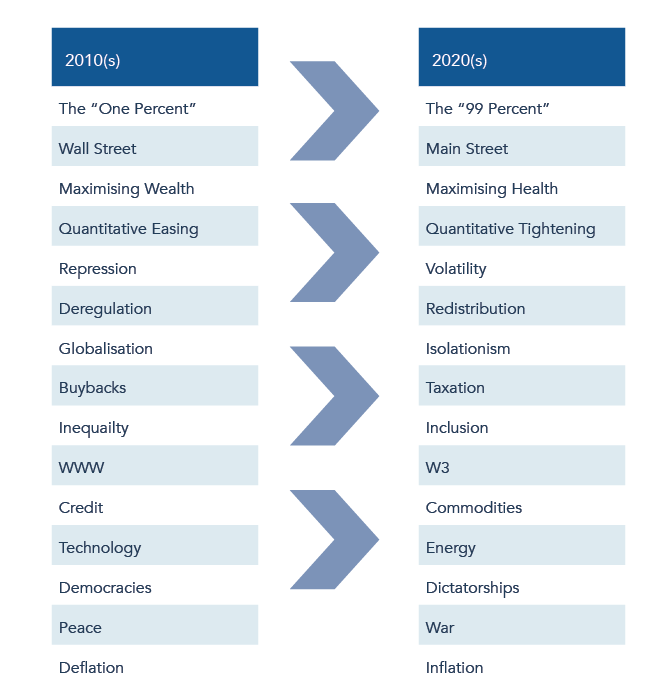

The last paper also included the following chart from Ian Hartnett at Bank of America:

Figure 1: Themes for 2010(s) vs 2020(s)

Source: Bank of America, 31 December 2022

We can debate each line as to the extent to which they are true but the sheer number of trends that are fundamentally changing is real. We are unlikely to go back to a world characterised by cheap money, cheap labour, cheap commodities, and experimental policy. Real, after inflation, returns are likely to be harder to come by.

So, what should we do? It is tempting to think that one should change the way one goes about investing to accommodate this new reality. There are many saying just that. Tempting but, in our view, wrong.

Don’t get mad, get even

Those who have read Warren Buffett’s famous article “How Inflation Swindles the Equity Investor” will be familiar with the below. Published in May 1977 in Fortune magazine, the arguments developed are as relevant today as ever. With the current backdrop perhaps resembling the 1970s more than more recent decades this is unsurprising. It is no secret that we at Troy are great admirers of Buffett’s approach and think investors would be well-served by reviewing his thoughts from around that time.

A sound investment approach, as explained so often by Mr Buffett, should aim to buy high quality assets at a fair price, with identifiable competitive advantages, allowing for sustainably high returns on capital. These should then be held for the long term to allow for compounding. We agree.

In addition to this we share his contention that this approach remains sound regardless of the backdrop, notably regarding inflation. After all Buffett honed his approach in inflationary times and still focused on the same sorts of companies and sectors which have created his incredible track record and which we also favour.

In the piece Buffett makes the point that generally the return on capital from equities, in aggregate and across time, is reasonably constant. It follows that there is an argument for viewing stocks as having a bond-like return albeit with inflation linking. The real return, that is after inflation, is predominantly a function of the prevailing inflation rate. Yes, over time good companies can raise price to offset inflation but over shorter periods the return is diminished. This is why inflation is often seen as a tax on wealth creation.

The importance of quality

He then drops in a more subtle point, which is how different businesses cope with an inflationary environment. It is not simply a function of how easy it is for a company to raise prices. To this must be added the inherent quality of the underlying business in terms of returns on capital as well as the capital requirements of the enterprise.

Simply put those companies that have high returns, and relatively low capital requirements are much better placed to cope with inflation.

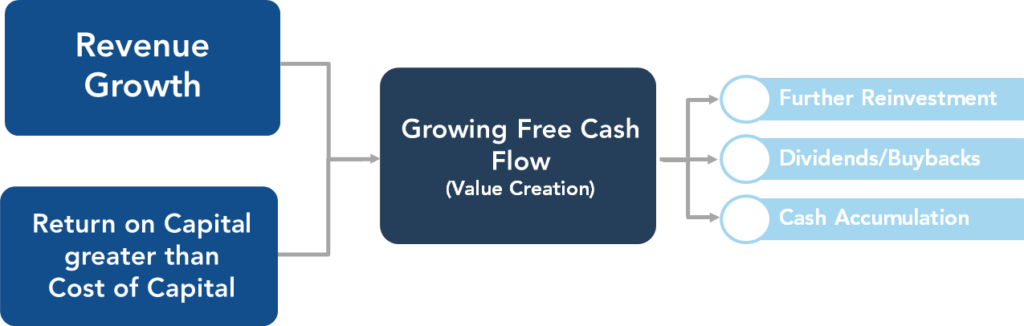

High quality companies have high returns on capital, which itself is a function of having low capital requirements. This sustains growing free cash flow which allows for both capital growth and income payments while maintaining a well invested business.

This does not change in an inflationary environment – quite the opposite.

We can see this by comparing a high-quality business with a less favoured enterprise and then observing what happens when inflation hits.

Figure 2: The importance of cash flow

Source: Troy Asset Management Limited, 30 April 2023.

Happily, Mr Buffett does this for us in his 1984 letter to Berkshire Hathaway shareholders in an appendix entitled “Goodwill and its Amortisation: The Rules and Realities”. He demonstrates the point by comparing the relative economics of his first ever fully acquired business, See’s Candy, with a less favoured, hypothetical, business.

See’s Candy was purchased for $25m with $8m of “net tangible assets “(capital) and no debt. On this capital base the company was earning $2m of post-tax income. This therefore represents a 25% return after tax on “net tangible assets” (also referred to as return on invested capital or ‘ROIC’).

Incidentally he goes on to explain how the company generates this very attractive return:

“relatively few businesses could be expected to consistently earn the 25% after tax on net tangible assets that was earned by See’s – doing it, furthermore, with conservative accounting and no financial leverage. It was not the fair market value of the inventories, receivables or fixed assets that produced the premium rates of return. Rather it was a combination of intangible assets, particularly a pervasive favorable reputation with consumers based upon countless pleasant experiences they have had with both product and personnel.

Such a reputation creates a consumer franchise that allows the value of the product to the purchaser, rather than its production cost, to be the major determinant of selling price.

Could there be a more succinct summary of why we are committed investors in consumer franchises with well-loved brands in our portfolio? Anyway, we digress.”

Compare and contrast

The comparison between the two businesses is described as follows “…let’s contrast a See’s kind of business with a more mundane business. When we purchased See’s in 1972, it will be recalled, it was earning about $2 million on $8 million of net tangible assets. Let us assume that our hypothetical mundane business then had $2 million of earnings also, but needed $18 million in net tangible assets for normal operations. Earning only 11% on required tangible assets, that mundane business would possess little or no economic Goodwill.

A business like that, therefore, might well have sold for the value of its net tangible assets, or for $18 million. In contrast, we paid $25 million for See’s, even though it had no more in earnings and less than half as much in “honest-to-God” assets..”

The numbers look like this:

| Year 1 | See’s Candy | Mundane business |

|---|---|---|

| Earnings | 2 | 2 |

| Invested Capital | 8 | 18 |

| ROIC (%) | 25 | 18 |

| Enterprise Value | 25 | 18 |

| Price to Earnings Ratio | 12.5 | 9 |

Buffett then goes on to consider what happens when inflation hits. We quote at length:

“…imagine the effect that a doubling of the price level would subsequently have on the two businesses. Both would need to double their nominal earnings to $4 million to keep themselves even with inflation. This would seem to be no great trick: just sell the same number of units at double earlier prices and, assuming profit margins remain unchanged, profits also must double.

But, crucially, to bring that about, both businesses probably would have to double their nominal investment in net tangible assets, since that is the kind of economic requirement that inflation usually imposes on businesses, both good and bad. A doubling of dollar sales means correspondingly more dollars must be employed immediately in receivables and inventories. Dollars employed in fixed assets will respond more slowly to inflation, but probably just as surely. And all of this inflation-required investment will produce no improvement in rate of return. The motivation for this investment is the survival of the business, not the prosperity of the owner.

Remember, however, that See’s had net tangible assets of only $8 million. So it would only have had to commit an additional $8 million to finance the capital needs imposed by inflation. The mundane business, meanwhile, had a burden over twice as large – a need for $18 million of additional capital.

After the dust had settled, the mundane business, now earning $4 million annually, might still be worth the value of its tangible assets, or $36 million. That means its owners would have gained only a dollar of nominal value for every new dollar invested. (This is the same dollar-for-dollar result they would have achieved if they had added money to a savings account.)

See’s, however, also earning $4 million, might be worth $50 million if valued (as it logically would be) on the same basis as it was at the time of our purchase. So it would have gained $25 million in nominal value while the owners were putting up only $8 million in additional capital – over $3 of nominal value gained for each $1 invested.”

The numbers after the effect of inflation look like this:

| Year 2 | See’s Candy | Mundane business |

|---|---|---|

| Earnings | 4 | 4 |

| Invested Capital | 16 | 36 |

| ROIC (%) | 25 | 9 |

| Enterprise Value | 50 | 36 |

| Price to Earnings Ratio | 12.5 | 9 |

Result:

| See’s Candy | Mundane business | |

|---|---|---|

| Valuation gain | 25 | 18 |

| Investment | 16 | 36 |

| Required investment (xY1earnings) | 25 | 9 |

The important point is that for a given level of inflation the better business can increase earnings without having to increase capital expenditure nearly as much as the more mundane business. This creates enormous value. Essentially the same competitive advantages that allow for high returns on capital also allow business to weather the effects of inflation more effectively.

Present day

Recent results in our portfolio have been consistent with the above. Companies such as Procter & Gamble (P&G), Pepsi and Reckitt Benckiser have all produced results ahead of expectations driven by pricing – as well as some signs of post-COVID margin expansion as input cost inflation has weakened.

Hence in the first quarter of 2023 (formally Q3 for the company as it has a June year-end) P&G delivered 7% organic sales growth (4% was expected) which allowed the company to raise long term expected growth to 6%. This was mainly a function of raising price, volume growth while lacklustre is expected to continue to recover. Gross margins also expanded for the first time in two years.

Pepsi managed a remarkable 14% organic sales growth and 18% full year earnings per share growth. Forward guidance was also raised. Again, Pepsi was able to increase prices to deliver these results. Gross margins also expanded.

Finally, Reckitt Benckiser, which it should be acknowledged is recovering from several stock specific issues, reported 7.9% organic sales growth derived from both pricing and improving (albeit still negative) volume.

In each case this shows an admirable degree of resiliency and adaptability in an inflationary backdrop. The combination of brand strength, distribution power and habitual customer behaviour allows these companies to raise prices without unduly diminishing demand. When combined with the attractive underlying economics of these businesses, robust results should continue to be able to be delivered. This consistency, at a time of great uncertainty, is valuable. It has reminded investors of the quality of these franchises especially at times of adversity.

Having established this point Buffett then goes on to describe why, logically, asset-heavy businesses are less well positioned:

“Any unleveraged business that requires some net tangible assets to operate (and almost all do) is hurt by inflation. Businesses needing little in the way of tangible assets simply are hurt the least.

And that fact, of course, has been hard for many people to grasp. For years the traditional wisdom – long on tradition, short on wisdom – held that inflation protection was best provided by businesses laden with natural resources, plants and machinery, or other tangible assets (“In Goods We Trust”). It doesn’t work that way. Asset-heavy businesses generally earn low rates of return – rates that often barely provide enough capital to fund the inflationary needs of the existing business, with nothing left over for real growth, for distribution to owners, or for acquisition of new businesses.

In contrast, a disproportionate number of the great business fortunes built up during the inflationary years arose from ownership of operations that combined intangibles of lasting value with relatively minor requirements for tangible assets. In such cases earnings have bounded upward in nominal dollars.”

There is nothing new under the sun

Doesn’t all this sound terribly familiar? 40 years after this was written I read the same arguments quoted above regularly recently. The existence of inflation does not mean we should suddenly invest in cyclical and capital-intensive businesses even if they are currently having their day in the sun.

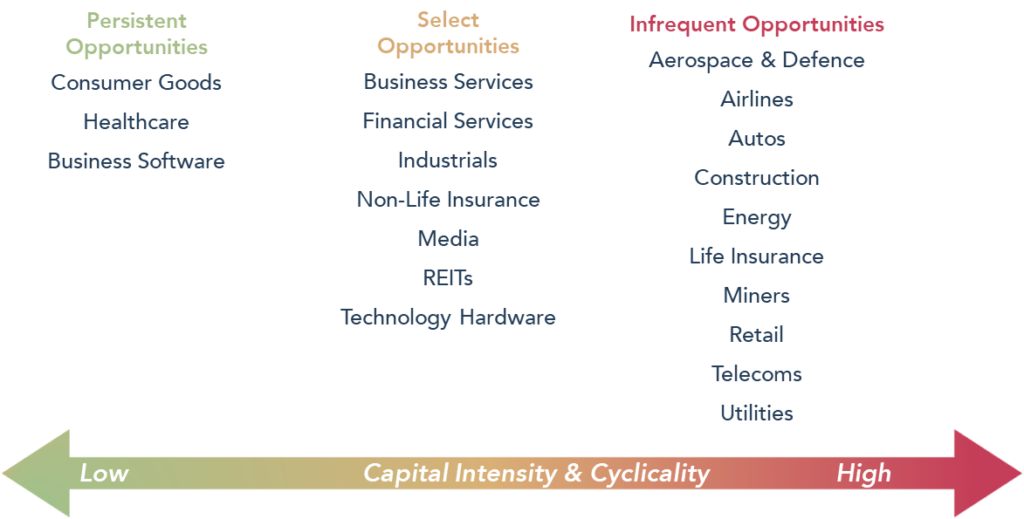

The chart below is a distillation of the arguments laid out above, by sector.

Figure 3: Our investment universe

Source: Troy Asset Management Limited, 30 April 2023.

There will always be a temptation to invest in what is performing right now, and for which there is doubtless a beguiling investment thesis, but which makes little sense when viewed through a long-term investment lens. It is only over time that this reality is revealed.

This underpins our distinctive investment approach which is highly selective about the businesses in which we invest. We seek to concentrate our efforts and resources in sectors and businesses that have the attributes described above. Having established such a high-quality portfolio, we interrupt the compounding of our businesses reluctantly as evidenced by the very low turnover in our funds. Further we seek to limit losses by being disciplined about valuation. This also enhances our ability to generate an attractive level of income. We have an absolute return mindset (as opposed to relative to a benchmark) and consider risk to be the permanent loss of capital rather than positioning relative to a benchmark.

A consistent approach

We continue to strive to produce above average returns with below average volatility and to deliver a return balanced between capital and income growth. Recent events have not caused us to change the way in which we approach this task. This should enable us to deliver growing free cash flow and income from the portfolio in the coming years even if inflation remains a problem.

1Warren E. Buffett, Fortune Magazine, May 1977, http://csinvesting.org/wp-content/uploads/2017/04/Inflation-Swindles-the-Equity-Investor.pdf

2https://warrenbuffettoninvestment.com/goodwill-and-its-amortization-the-rules-and-the-realities/

Please refer to Troy’s Glossary of Investment terms here. The document has been provided for information purposes only. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. The document does not have regard to the investment objectives, financial situation or particular needs of any particular person. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The views expressed reflect the views of Troy Asset Management Limited at the date of this document; however, the views are not guarantees, should not be relied upon and may be subject to change without notice. No warranty is given as to the accuracy or completeness of the information included or provided by a third party in this document. Third party data may belong to a third party. Past performance is not a guide to future performance. All references to benchmarks are for comparative purposes only. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The investment policy and process of the may not be suitable for all investors. Tax legislation and the levels of relief from taxation can change at any time. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Issued by Troy Asset Management Limited (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training.© Troy Asset Management Limited 2023.