Happy new decade!

The start of any new year is an opportunity to reflect on the present and make resolutions for the future. This year the opportunity is made all the greater by the passage (at the end of 2023) of the Troy Global Equity Strategy’s 10-year anniversary. We are pleased to have added value for the Strategy’s investors over this time. The compound annual return since inception is +12.2% (net of fees) which compares to the benchmark MSCI World Index return of +11.5%. This results in a cumulative gain of +217.0% for the Strategy compared to +196.5% for the Index.

It is both humbling and insightful to look back over a decade of managing the Strategy. Despite all the daily toil, it is startling how only a few decisions have made the difference. It is also telling that those main drivers of value creation over the last decade were predictable and did not require complex thinking or heroic macro-economic assumptions. The overriding feature over this time has been the unceasing and astonishing growth of digital commerce. We knew this was an unstoppable force in 2013 and we are highly confident that we will be navigating its influence 10 years from now. It’s a reminder, if one were needed, that successful investment is ‘simple but not easy’.1

An online report card

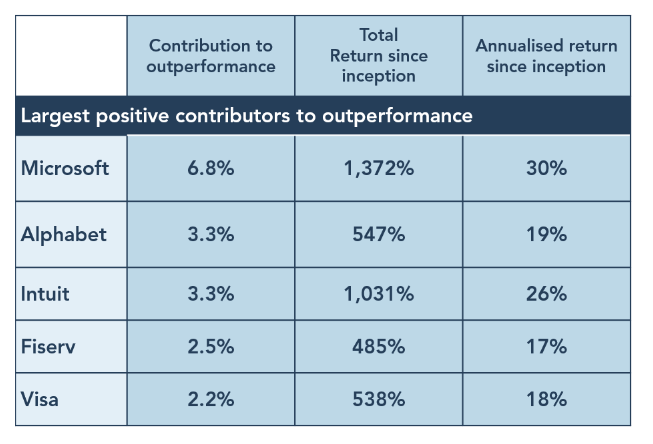

With the exception of Visa (first purchased in 2016), the largest positive contributors to the Strategy’s outperformance over the 10-year period were stocks held for the entire decade.

Source: FactSet and Troy Asset Management Limited, 31 December 2013 to 31 December 2023. Past performance is not a guide to future performance. Attribution is provided as gross absolute returns in base currency and does not include charges and fees. The impact of fees will have the effect of reducing performance.

All five are beneficiaries of digitisation in one form or another – via the internet’s expanding share of economic output, the growth of digital payments, and the increased importance of software and automation. Each company has grown revenues, profits and cashflows at double-digit annualised rates during the period, with high free cash flow margins and above average incremental returns on capital. These companies, in our opinion, are managed for the long term by management teams that strongly align with their other stakeholders (customers, employees, suppliers, and communities). Happily, their shares never reached extreme valuations and hence they have been core holdings for the Strategy throughout, and remain so. Looking further down the 10-year investment report card, it’s no surprise that the winning holdings follow a similar thread – companies such as Experian, Booking Holdings and L’Oréal, for example, delivered above average annual growth in revenues and cashflows with strong free cash flow margins . They invested in digital trends to stay at the vanguard of their industries and all the while their valuations were manageable. Again, oh so simple in retrospect, not so easy in practice.

Raising the bar

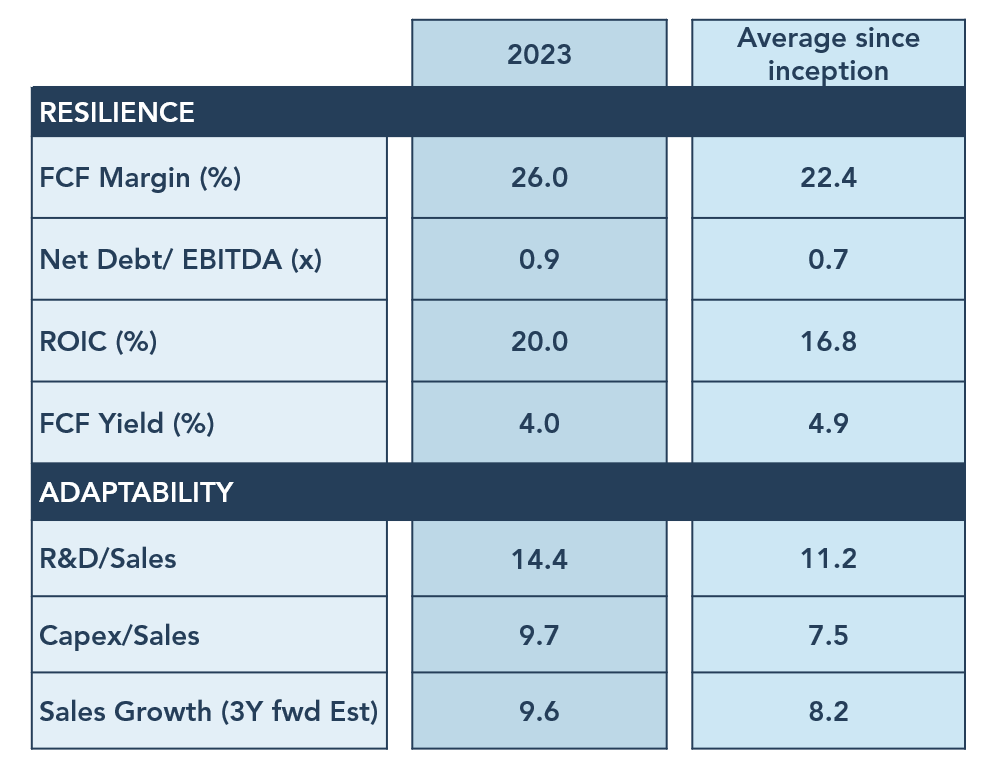

Perhaps unsurprisingly, the ownership of these exceptional companies has profoundly impacted our thinking about the rest of the portfolio. Longstanding investors in Troy funds will know the efforts to which we go to invest in resilient companies – those with strong financial profiles, consistent and predictable revenues and cashflows, strong balance sheets, and those managed by trusted stewards of capital. Valuation has always been an important consideration for us. But witnessing at first hand the magic that happens when a company grows at above average rates, whilst generating prodigious amounts of cash that can be reinvested at very high rates of incremental profitability, has had a major influence on the evolving shape of the Strategy. We demand an even deeper understanding of competitive advantage and the reinvestment that sustains growth. Our companies must adapt. The result is a portfolio with superior average cash margins, higher rates of reinvestment and returns on invested capital.

Source: FactSet and Troy Asset Management Limited, 31 December 2013 to 31 December 2023. Past performance is not a guide to future performance. Characteristics are shown excluding banks. FCF measures are based on trailing figures over the last 12 months. Asset allocation subject to change. Please refer to Troy’s glossary of terms.

Value investing in value creators

A review of portfolio changes over the past 10 years highlights that the holdings we own today have materially higher rates of growth in revenue, earnings and free cash flow than the companies that we have sold during the decade.

10 Year CAGRs for current holdings vs stocks sold

CAGR stands for Compound Annual Growth Rate. EPS stands for Earnings Per Share. Source: FactSet and Troy Asset Management Limited, 31 December 2013 to 31 December 2023. Past performance is not a guide to future performance. FCF measures are based on trailing figures over the last 12 months. Asset allocation and holdings subject to change.

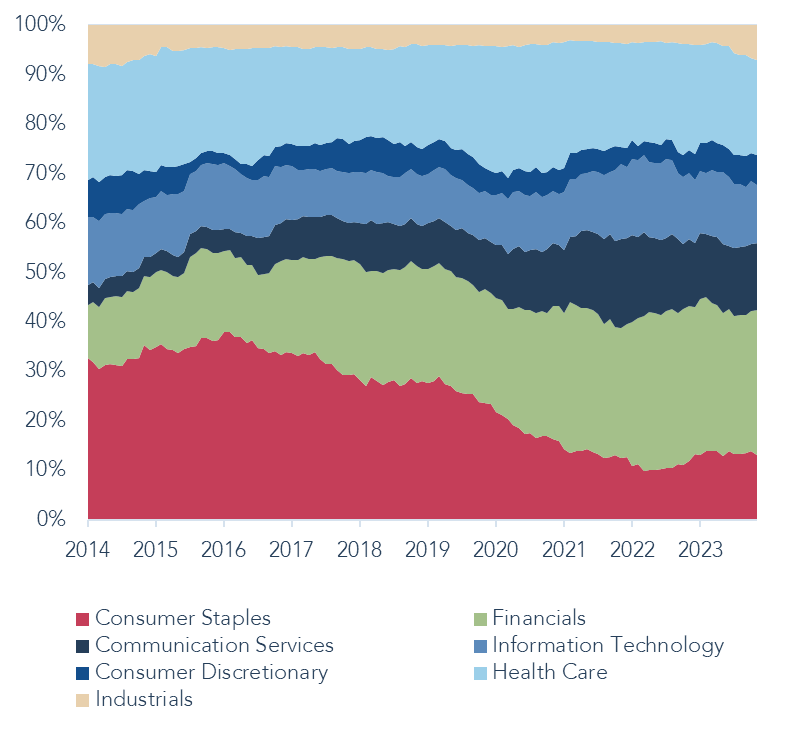

The Strategy in 2024 has more allocated to companies in payments (counted under ‘Financials’) and consumer internet companies (‘Communication Services’) and has significantly less invested in the slower-growing consumer staples sector.

Historic sector allocation

Source: FactSet and Troy Asset Management Limited, 31 December 2023. Asset allocation and holdings subject to change.

Critically though, the uptick in growth and financial productivity has not been matched by a dramatic increase in valuation. The average free cash flow yield of the Strategy is somewhat lower than it was 10 years ago, but not excessively so, and it is acceptable considering the improving financial profile. The core premise of the Strategy – that equity markets persistently underestimate the compounding power of rare and special businesses – appears to be alive and well. We are very happy to exploit it.

Increased accountability

The changes to the Strategy over the last decade go beyond the easily quantifiable. The growing importance of sustainability has informed our decision making. Our research has encompassed analysis of supply chains, energy intensity, plastics, water intensity, child labour and the driving influence of corporate culture. Companies are increasingly navigating complex and challenging regulatory environments where accountability to a wider set of stakeholders poses greater risk. We now hold our companies to a higher account on a range of material social and environmental issues. Not, to be clear, to force any moral agenda, but because we firmly believe that successfully negotiating trade-offs between stakeholders is an essential part of adapting to the world in which we live. The significance of these also grows with an investment horizon that is measured in decades rather than months or years. Our ESG work is therefore directly linked to our understanding of competitive advantage and the sustainability of long-term shareholder returns.

The power of the team

We are very fortunate that Troy Asset Management has grown and thrived over the past decade, and we are proud of the global investment team that we have created. Back at the end of 2013 there were six of us and now we are an investment team of fourteen people. They have been carefully assembled for cognitive diversity, levels of experience, and complementary academic backgrounds. Our investment processes and tools have advanced as has the depth and quality of our research. The Troy Global Equity Strategy has benefitted from valuable work by our colleagues on portfolio holdings including Agilent, RELX, LSEG, LVMH and Visa. Just as we have sought to raise the bar on the companies in which we invest for the Strategy, the team consistently looks to learn from mistakes and improve decision making.2 The increased capacity of the team has allowed us to look at more companies and, more importantly, go deeper in our analysis. This gives us the confidence to invest with greater conviction and over time the Strategy has become more concentrated. There is, of course, a balance to be struck. We carefully guard our team culture, limit bureaucracy and the dangers of group think, and always seek to align with our investors’ best interests.3

The next 10 years

It is an enormous privilege to have managed the Strategy for the past 10 years. We have been on an incredible journey, and compared to when it started, the Strategy enjoys significantly stronger underlying financial characteristics, competitive advantages, and growth opportunities. As the Strategy evolves, we have maintained a keen focus on valuations and continue to see a compelling balance between the quality of the portfolio’s companies and their prospective returns. Our team has grown and has raised the volume and quality of its analysis. All this leaves us excited about the next 10 years and eager to continue finding ways to improve all aspects of what we do.

We thank you for your continued support, trust, and interest in the Troy Global Equity Strategy.

1The phrase was popularised by its use as a title of a book by UK investor Richard Oldfield, but as far as we can tell – like many investment ideas – it traces its origins back to Warren Buffett.

2Some of the most important lessons learnt in managing the Strategy are reviewed here.

3For more detail on how we do this, see here.

Disclaimer

The Fund was originally launched as the Trojan Capital Fund, which focused on investing in UK equities with the flexibility to invest in overseas equities and other asset classes. The strategy was changed to a global equity strategy in December 2013. The Fund has been a constituent of the IA Global sector since April 2012. Prior to this, the Fund was in the IA Flexible Investment sector.

The information shown relates to a mandate which is representative of, and has been managed in accordance with, Troy Asset Management Limited’s Global Equity Strategy. This information is not intended as an invitation or an inducement to invest in the shares of the relevant fund.

Please refer to Troy’s Glossary of investment terms here. Performance data provided is either calculated as net or gross of fees as specified in the relevant slide. Fees will have the effect of reducing performance. Past performance is not a guide to future performance. All references to benchmarks are for comparative purposes only. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. There is no guarantee that the strategy will achieve its objective. The investment policy and process may not be suitable for all investors. If you are in any doubt about whether investment policy and process is suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. This is a marketing communication document.

Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The opinions expressed are expressed at the date of this document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice. Third party data is provided without warranty or liability and may belong to a third party.

Issued by Troy Asset Management Limited, 33 Davies Street, London W1K 4BP (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. Any product described in this document is neither available nor offered in the USA or to U.S. Persons.

© Troy Asset Management Limited 2024.