Inflation – Stealing from savers

“Make no mistake about it, inflation is a tax and not by accident”.

Ronald Reagan, 1974

The concept of inflation is a simple one, it is a measure of how prices across the economy are changing. However, the headline number hides an array of clues as to where prices may move in the future and how that may impact consumers, the economy and financial markets. The focus of this report is on the US and UK, as most of our assets today are dollar or sterling-denominated, but similar trends exist in much of the developed world.1

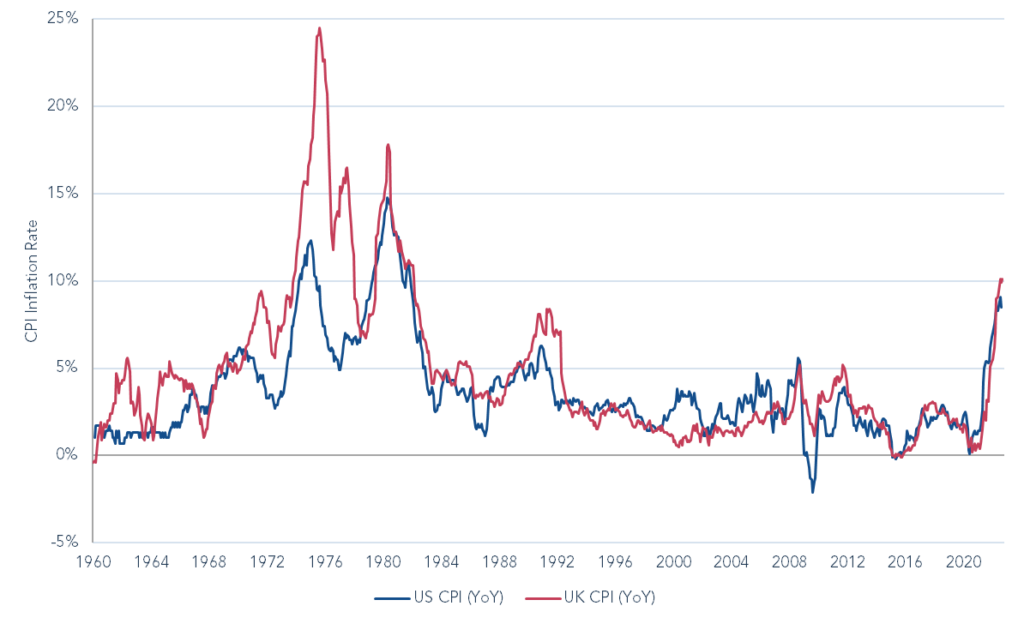

Figure 1: US and UK Inflation Rates (CPI, YOY)

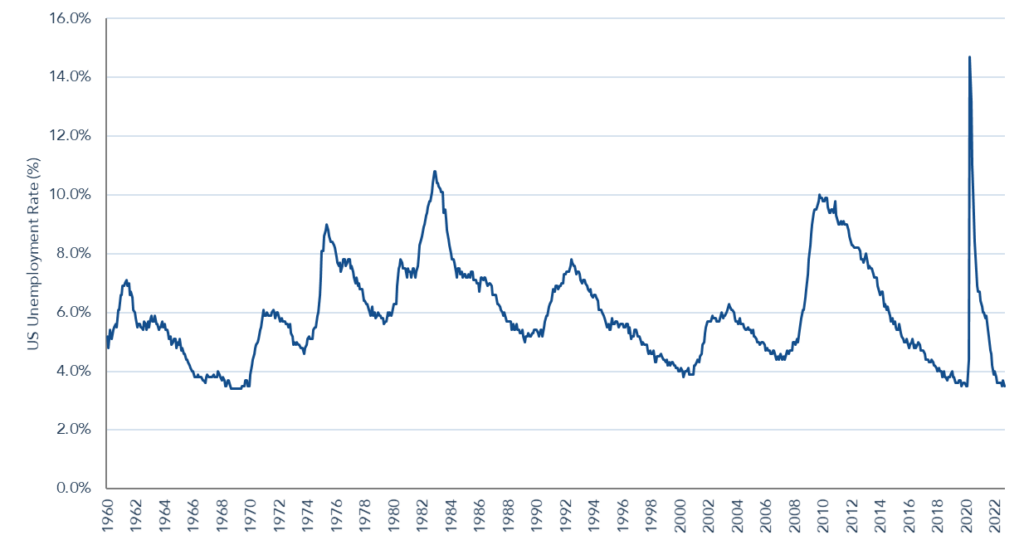

Figure 2: US Unemployment Rate

Decades of relatively benign inflation have meant most people have not had to focus on ‘real’ returns, but this has now changed. If a saver receives 1% interest on the savings in their bank account but inflation is at 10%, then the individual is losing -9% each year in real terms. With Bank of England interest rates struck at 2.25% today, the vast majority of savers in the UK are currently earning a negative real return on their savings and losing purchasing power each day. Figure 1 highlights the scale of the inflation problem, with headline rates recently reaching 9% and 10% in the US and UK respectively. Such high inflation has never been experienced by most of the US and UK populations, with similar levels last seen in 1981.

It is worth considering what items impact the inflation calculation. Many people think of inflation as representing a basket of goods they may buy in a supermarket. However, food for consumption at home makes up only 8% of the Consumer Price Index (“CPI”) in the US. Rent and housing costs make up a third of the total, with services, predominantly driven by wage costs, making up a further 28% of the index. Rent rises have a strong correlation with wage growth, suggesting that as much as 61% of inflation is driven by the cost of labour. Understanding wage growth is therefore our focus when considering the risk that high inflation persists.

What caused the recent increase in inflation?

2020 started with the Bank of England base rate at 0.75%, already exceptionally low by historical standards. Central bank data highlight that UK interest rates had never been so low in the 315 years leading up to 2009, as far back as the data goes. Against this backdrop, Covid’s arrival prompted governments to launch huge fiscal stimulus, whilst goods production and supply chains were challenged by the virus. The US government posted $1,400 cheques to any citizen earning less than $75,000 a year, regardless of whether their employment was impacted by Covid. The UK government offered to cover half of the cost of any meal in a restaurant. To fund the huge increase in spending, central banks bought trillions of dollars of government bonds and simultaneously lowered interest rates to near zero.

The outcome of this fiscal largesse was too much money chasing too few goods, with price rises the inevitable consequence. People could not spend their income fast enough and Covid saw US consumers in aggregate save an excess $2.75tn. Initially, the price rises were focused on certain hotspots, in particular the price of energy and used vehicles rose as consumers started to spend their excess savings.

As the world moved closer to normality, a strong recovery in the consumption of services was visible. The pandemic also meant some people of working age exited the workforce through illness, a need to care for family or concern over their health. Immigration was curtailed as travel restrictions remained in place. Demand for staff increased as the workforce shrank, resulting in close to record low unemployment in the US of 3.5% (Figure 2). As unemployment reaches the lower bound, companies end up bidding for staff and wage inflation ensues.

Why might inflation remain high?

Wage inflation is important because as people earn more they usually spend more, raising the risk of further inflation and higher wages required to meet the rising costs of living – a wage-price spiral. This process leads to more persistent inflation that is harder for central banks to tame. A common measure that helps to understand inflation’s persistence is ‘core CPI’, which excludes food and energy items.

Core CPI is obviously nonsense because both excluded categories are essential for human life, but the idea is to remove volatile items that frequently change in price and which can therefore distort the headline inflation number.

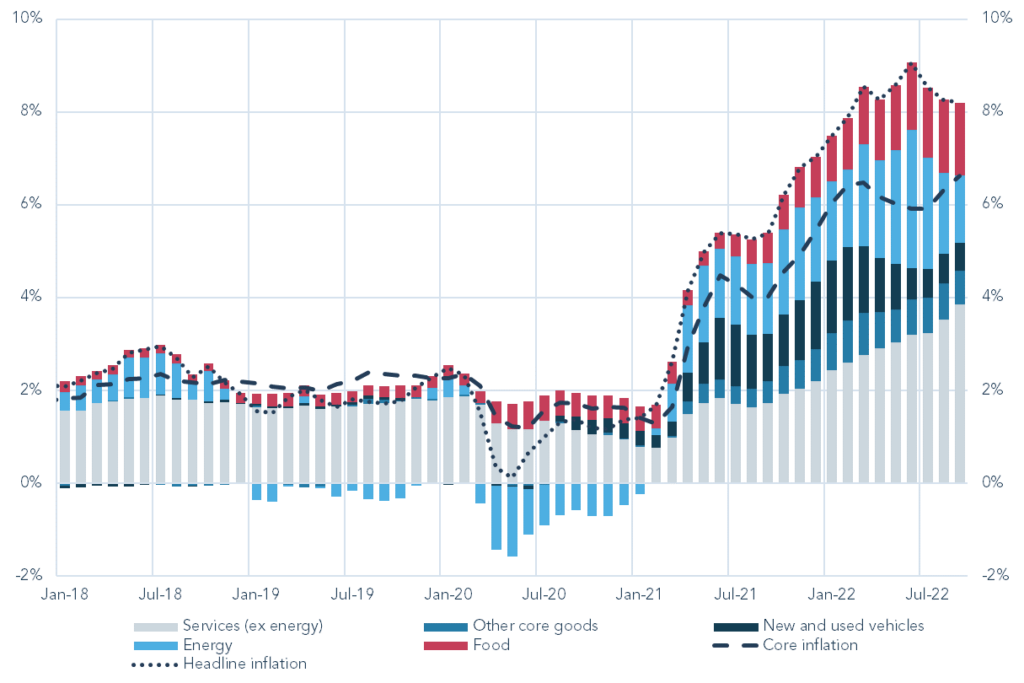

Figure 3: US Inflation Contribution

Figure 3 shows how core inflation has markedly increased, and how the drivers of inflation have moved from specific, supply-constrained items, like vehicles and electronics, to a much broader range of goods and services.

As previously shown in Figure 2, wage-driven inflation is being caused by a lack of available workers to meet the economy’s strong demand for services. Options available to the central bank for fixing this include: 1) finding millions more workers, 2) reducing demand for services, or 3) creating slack in the labour market by raising the companies’ costs of capital and forcing corporates to slow wage growth and/or make redundancies. Central banks cannot conjure up workers at will and immigration is politically unpopular. Nor can they directly control the rent component of services. Options 2 and 3 are the only politically viable ones and both are likely to cause a recession. Unemployment likely needs to rise to tame inflation, but the measure has never risen more than 0.5 percentage points in the US without a recession. The odds of a ‘soft-landing’ for the economy, or rate rises without a recession, are therefore remote. The impact of a recession on inflation is uncertain; inflation would likely slow but the extent of this is unclear; the market is currently expecting US CPI of just over 1% in a year’s time, settling back around 2% beyond that point. We suspect the steady-state may be higher than that.

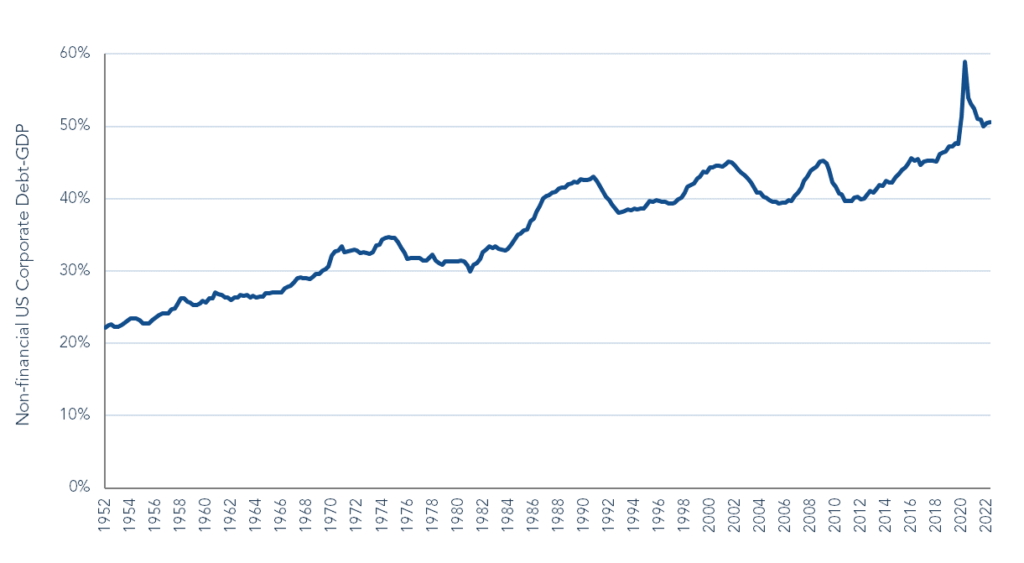

The inflation outlook is complicated by high debt levels (Figure 4 ). Four decades of ultra-low interest rates meant governments, corporates and households have taken on ever greater levels of borrowing. This creates a challenge for the Federal Reserve, as it limits their ability to raise interest rates above inflation, as Federal Reserve Chairman Paul Volcker did in the 1980s, without causing a deep recession. The outcome could be that the Federal Reserve pivots away from further rate rises to limit the economic damage, allowing inflation to run higher for longer than it otherwise would.

Geopolitics is another factor to consider. The grim war in Ukraine creates great uncertainty, particularly in Europe. Governments are having to invest in working out how to keep the lights on and homes warm. Investing in alternative energy supply is likely to be a multi-year inflationary pressure as countries attempt to build resilience.

Relations between China and the US are also in focus as the trade war escalates. Increasingly, companies are talking about diversifying supply chains to avoid an overreliance on exporting Chinese-made goods, which will come at an inflationary cost with little short-term benefit. After decades of globalisation many companies are now considering bringing manufacturing closer to home. If this is to pass, consumers are likely to ultimately foot the bill as companies raise retail prices to cover their higher production costs.

Figure 4: US non-financial corporates -debt-to-GDP

How to protect capital in this environment?

Current trends suggest a scenario of higher inflation and possibly greater variability for inflation trends. This creates an environment few investors have experienced or fully considered.

Within equities, such conditions will separate exceptional businesses and management teams from the rest. Few executives have managed a business with the level of goods and wage inflation seen today. The high odds of recession further complicate the outlook for management and all companies are caught in powerful macroeconomic crosscurrents.

As central banks aggressively raise interest rates, bond yields have followed. The US 10-year Treasury yields 4.2% today. This has profound implications for the cost of capital and how equities are valued. Faster growing companies with higher valuations are inherently more sensitive to changes in the cost of capital when compared to slower-growing businesses, as more of the value is based on earnings in the future. These distant earnings need to be discounted at a higher rate today than they did a year ago. We have seen this dynamic play out this year as many speculative technology companies have lost the vast majority of their value. If higher inflation persists, it is reasonable to expect that this continues.

At a more basic level, the bar is higher for all companies when investors can earn over 4% per year for a decade in a government bond. Companies on reasonable valuations that are able to raise prices and grow earnings are strongly preferred. Our caution on both earnings and valuation risk is reflected in the multi-asset portfolios having the lowest equity weighting for over 15 years, at 26%.

The multi-asset strategy at Troy currently has a 38% allocation to Treasury Inflation-Protected Securities (TIPS). These are bonds issued by the US government that adjust their value based on inflation. Pleasingly, these offer a positive real yield at all maturities today, meaning an investor that buys TIPS at current prices and holds to maturity is guaranteed a return ahead of inflation.

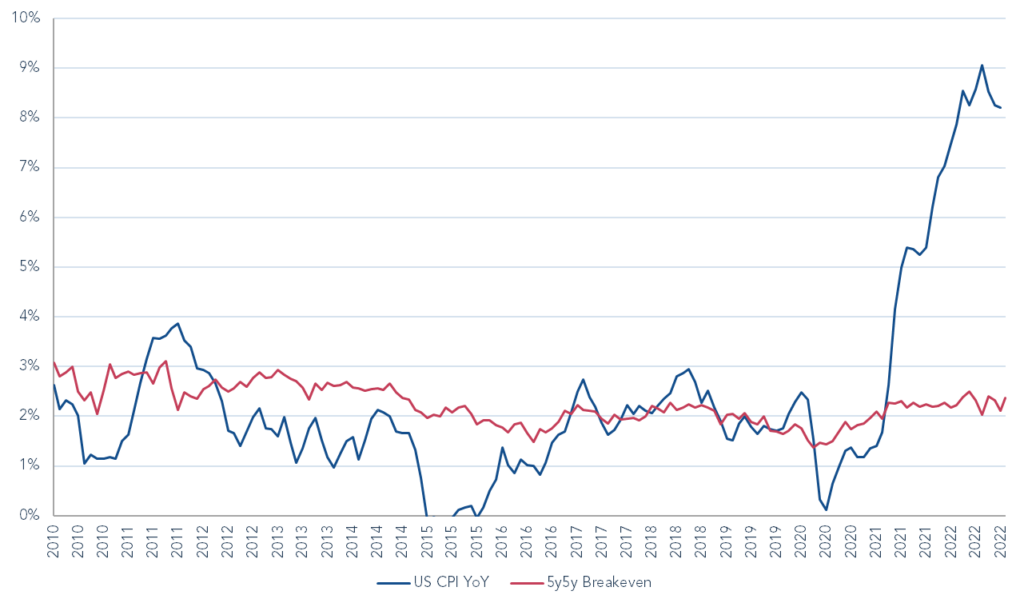

A closer look at TIPS shows that the market is surprisingly sanguine about inflation (Figure 5). Breakevens, a proxy for the market’s inflation expectation derived from TIPS, show that the market is today expecting inflation to be 2.3% per annum between 2028 and 2033 (five-year annual inflation, five years into the future). Despite the high inflation seen today, markets remain anchored in the past and are betting that inflation will return approximately to the Federal Reserve’s 2% target. We would argue this is missing the obvious and increasing risk that inflation persists at higher rates and for longer. The strategy’s TIPS will generate good real returns in this scenario.

Figure: US Inflation and 5-Years Inflation Breakevens

Our final layer of defence against inflation is our holding in gold. This investment is unhedged, meaning the relevant return is gold’s price in sterling. Gold has generated a +10% return in 2022 (to the end of September) in sterling terms, one of the best performing asset classes this year. We expect gold to continue to protect capital as currencies debase with real interest rates remaining significantly negative. Gold offers this protection at a minimal cost compared to complex derivative strategies that typically enrich the investment banks that issue them ahead of clients.

While the outlook is highly uncertain, the current environment of higher yields for government bonds should lead to a continued repricing of equities, creating an opportunity for patient investors to purchase companies at attractive valuations. We remain ready to put the strategy’s liquid assets to work when the opportunity arises.

Disclaimer

All information in this document is correct as at 27 October 2022 unless stated otherwise. Please refer to Troy’s Glossary of Investment terms here. The information presented shows the performance of a UK UCITS, the assets of which are, and have been managed in accordance with Troy Asset Management Limited’s Multi-Asset Strategy. Past performance is not a guide to future performance. The document has been provided for information purposes only. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. The document does not have regard to the investment objectives, financial situation or particular needs of any particular person. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The views expressed reflect the views of Troy Asset Management Limited at the date of this document; however, the views are not guarantees, should not be relied upon and may be subject to change without notice. No warranty is given as to the accuracy or completeness of the information included or provided by a third party in this document. Third party data may belong to a third party. Benchmarks are used for comparative purposes only.

Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. Any decision to invest should be based on information contained in the prospectus, the relevant key investor information document and the latest report and accounts. The investment policy and process of the fund(s) may not be suitable for all investors. If you are in any doubt about whether the fund(s) is/are suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Asset allocation and holdings within the fund may be subject to change. Investments in emerging markets are higher risk and potentially more volatile than those in developed markets.

All references to indices are for comparative purposes only. All reference to FTSE indices or data used in this presentation is © FTSE International Limited (“FTSE”) 2022. ‘FTSE ®’ is a trade mark of the London Stock Exchange Group companies and is used by FTSE under licence.

Issued by Troy Asset Management Limited, 33 Davies Street, London W1K 4BP (registered in England & Wales No. 3930846). Registered office: Hill House, 1 Little New Street, London EC4A 3TR. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. The fund described in this document is neither available nor offered in the USA or to U.S. Persons.