The tightening of monetary policy can work with a long and variable lag, and it seems that dramatic increases in the cost of capital are yet to be fully felt by the global economy.

In Investment Report No.77, Sebastian Lyon and Charlotte Yonge explain why the penny is yet to drop and how funds in the multi-asset strategy are positioned defensively to protect well if it does.

Tomorrow’s World

We are slowly emerging from a prolonged period of distortion born of zero interest rates. The process of unwinding the excess will take time and require patience on the part of investors. The UK’s investment trust sector offers a window into some of the areas of distress. As of 19th July, only 22 close-ended funds, out of a total of 367 in the sector, were trading on a premium to their net asset value. This compares with 105 trading on a premium in 2021. Many of the steepest discounts are on trusts whose business models are inherently geared, from social housing to private equity and music royalties. In most instances, discounts have widened in the expectation that the underlying assets are worth less than they were 18 months ago when rates were zero. However, the investments themselves are yet to be fully ‘marked to market’. We do not own illiquid assets in our multi-asset strategy and the investment trusts we manage operate a discount control mechanism to minimise deviations in the share price from Net Asset Value. Our returns for the multi-asset strategy year-to-date have been roughly flat.

The first six months of this year have been discombobulating for investors. While there have been many indicators of a bubble deflating, as the effects of tighter monetary policy are felt across asset classes, this has strangely coincided with an echo bubble1 of significant proportions in a very small number of large-cap tech stocks. The U.K. stock market, starved of tech exposure, has not really participated in the rally, but American stocks have appreciated strongly and behaved as if the painful falls of 2022 were a distant memory. The rally has been, by historical standards, very narrow with seven stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) accounting for over 77% of the index performance in the first half of 2023. Such concentration is not usually a sign of stock market health, and it is notable that these gains have been driven by higher valuations rather than by earnings growth. (See our colleague Marc de Vos’s Special Paper No.12 on the remarkable growth and impact of value-indifferent investors).

This investment narrative lies behind the enthusiasm for Nvidia, this year’s stock market darling. Nvidia, which designs and develops graphics processors, is up more than 200% year-to-date. We do not hold this stock, which is trading on nearly 200x historic earnings per share, but we do own both Microsoft and Alphabet on more reasonable valuations. Both businesses have been integrating AI into their products for years; it is highly likely that the progress made in the past few months will, in different ways, enhance each company’s potential. But there is also a risk that the market expects jam today. If a recession starts to impact IT and advertising budgets, the narrative currently driving the tech behemoths will likely change once again.

At a high level, and over a number of years, we expect that AI will do much for the real economy and productivity. As with the internet, AI will likely impact on industries in ways we cannot imagine today. Think not only of the business models which exist now thanks to the internet (Uber, Airbnb) but also of the scores of traditional businesses which now operate in entirely new ways. Nestlé, for example, sells over half its 14 billion Nespresso coffee pods online every year. Other businesses have been rendered obsolete. Often the losers are easier to identify than the winners. Digital learning companies appear to be the first victims of generative AI. We expect the stock market’s Pavlovian response to AI will dissipate to become more nuanced, but also that its effects will be wider reaching than recent share price moves in a select number of companies might suggest.

Picks ‘n Shovels

I did not expect to hear the phrase ‘Picks ‘n Shovels’ again in the context of an investment strategy, but I suppose it shows that these expressions come around every once in a while. First used in the context of the gold rush of 1849, those who sold the prospectors the mining equipment were the ones to make the money, while most of the speculators ended up empty-handed. We saw this film two decades ago after the dot-com boom. Back then, investors coalesced around a small number of telecoms equipment companies, including Cisco, Lucent, Ericsson, Nortel and Marconi. These stocks would, the story went, benefit from building the infrastructure for the internet boom, without investors having to identify the dot-com winners. Valuations for these companies reached eye-watering levels of 50-100 times earnings, discounting growth that ultimately failed to materialise as the bubble burst and America headed into recession. The companies’ share prices never fully recovered. We now know that the pre-eminent dot-com winner was Amazon, but only after the company’s share price had fallen -95% from December 1999 to October 2001.

Investment in nascent business models, whether by venture capitalists or more risk-seeking public equity market investors, is an essential component of well-functioning economies that promote competition and innovation. The profile of returns from this type of investing is not however suitable for all. This can be forgotten when a compelling narrative and the promise of outsized rewards renders investors blind to the downside. Such risks are particularly high when the cost of capital is zero, causing winning streaks to morph into bubbles. Such was the case during the work-from-home boom, with investors far and wide buying shares in Zoom and Peloton. Three years on, and these investors are nursing large losses. With our objective of ‘protect and grow’, it is essential that we focus on the protection component of the mandate during such moments of euphoria. AI may well be different but very high valuations tend to lead to high volatility and low returns – we seek to steer clear of both. As Jeremy Grantham reminds us, ‘volatility is a symptom that people have no idea of the underlying value.’ For us, investing is as much about what we avoid as what we own.

Our job, as investors in stock markets, is to envisage tomorrow’s world. Not science fiction or speculation but whether cash flows will be higher or lower in the future and what those cash flows are worth today. For the first time in 15 years, we have a risk-free interest rate. This higher cost of capital will ultimately equate to more conservative valuations. In exiting the hall of mirrors, we will return to a world where egregious multiples of uncertain cash flows can no longer be justified.

An insidious environment

For the moment, investors find themselves in a more precarious position. We recently interviewed the venerable market commentator Kiril Sokoloff, Chairman and Founder of 13D Research, as part of our podcast series, ‘Far From The Finishing Post’ (Listen here). Kiril argues that today is a particularly challenging investment environment. If investors’ job is to discount future cash flows, it is hard enough to forecast what those cash flows will be, let alone the cost of capital at which they should be discounted. This is particularly true today when the probability of a recession is higher, thus rendering those cash flows more uncertain. We are also at a juncture where interest rates have risen at their quickest pace in forty years. We suspect rates are likely to stay higher for longer as the outlook for inflation remains uncertain.

We wrote in January about stock market participants’ insensitivity to valuation after fourteen years of historically low interest rates. Akin to the proverbial frogs in boiling water, higher multiples of earnings have become the norm for investors. This year’s rally would seem to confirm a willingness to suspend disbelief and revert to a bull market built on above-average valuations. The fact that the price-to-earnings ratio on the S&P 500 is back to where it was in 2019, ignores the fact that the pre- COVID era was a historic anomaly in terms of the low cost of capital on offer. The picture has changed dramatically over the past 18 months, something that markets started to respond to in 2022. It is Kiril’s view that we remain in a bear market today and we agree. He notes that this year’s rally is in keeping with bear markets’ tendency to lure everyone back in before falling further. In his words, the current dynamics make this one of the most insidious and dangerous bear markets ever.

Long and variable lags

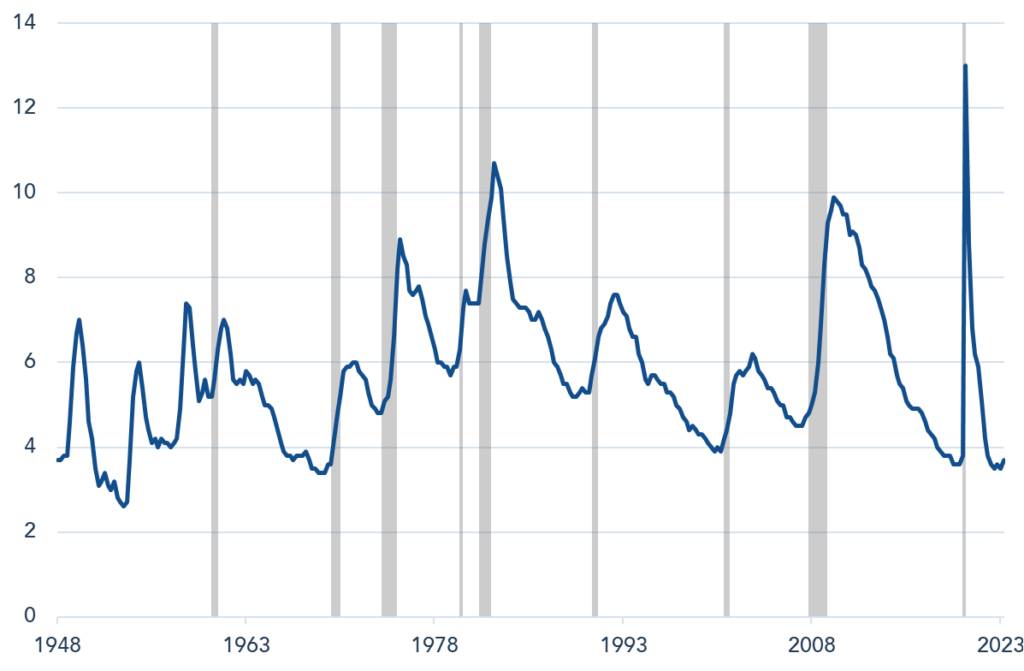

With markets in positive territory, investors are focusing on coincident and lagging economic indicators. Levels of unemployment remain near cycle lows, and we have heard the argument that this is consistent with a soft landing. This is not however forward-looking; unemployment has historically troughed a few months ahead of a recession (Figure 1). It is a symptom of recession, not a cause. In the words of the U.S. National Bureau of Economic Research, the body responsible for officially declaring recession, ‘contractions (recessions) start at the peak of a business cycle and end at the trough’.

Figure 1 – US UNEMPLOYMENT RATE (%)

Past performance is not a guide to future performance.

Source: Bloomberg, The Daily Shot, 7 July 2023. Shaded areas indicate recessions.

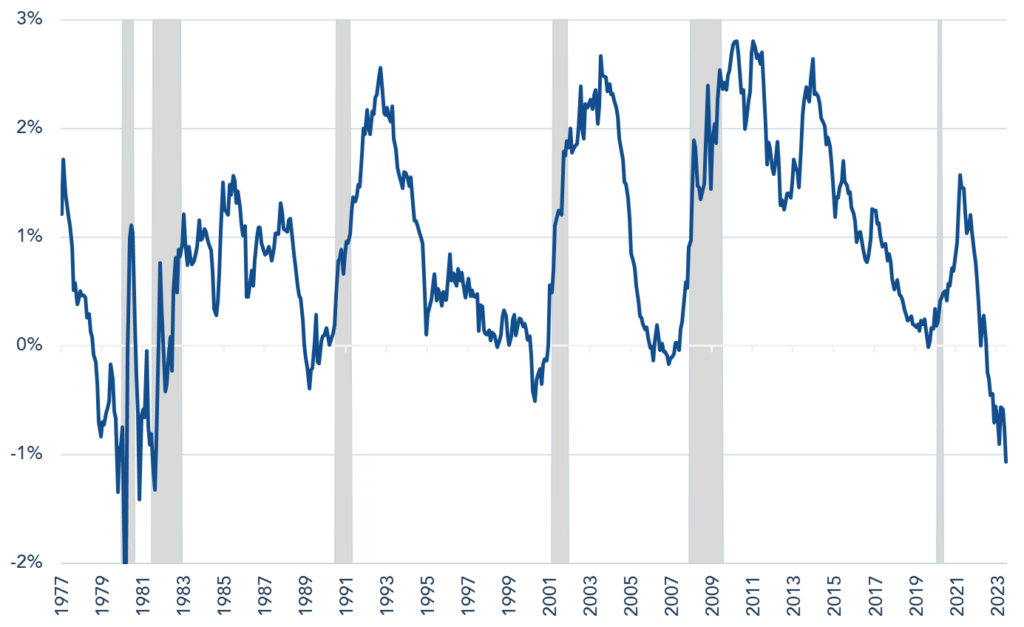

When it comes to looking into the future, the bond market has historically been a more helpful guide. In the past, when short-dated yields have traded higher than longer-dated, recession has followed. This is known as an ‘inverted yield curve’ and it is reflective of the fact that the bond market is looking forward and pricing in rate cuts, made by the relevant central bank, in response to a downturn. Today the US Treasury market is exhibiting the most inverted yield curve since the 1980s (Figure 2).

The most important fact that will bear on the economic outlook is the recent, dramatic increase in the cost of debt. This becomes relevant when companies and consumers refinance their borrowings or take out a new loan. For many small businesses, this is already happening. According to research from Jefferies, the corporate lending environment has deteriorated to levels approaching previous downturns in America in the early 1990s, 2000, or the sub-prime crisis of 2007. 122 U.S. public or private companies with liabilities over $50m have already filed for bankruptcy protection this year, implying a run rate of more than 200 by year end, comparable to that during the Global Financial Crisis (GFC) and the pandemic.

There are plenty of reasons why the transmission effect of tighter monetary policy has been slower this time. Savings pent-up during COVID have been mostly run down in the U.S over the last year. The prevalence of fixed-rate mortgages has delayed but not removed the effects which are slowly being felt. Finally, due to the boom in private equity and credit since the GFC, evidence of a downturn may take longer to appear than in previous cycles as valuations are not quickly marked to market. The penny has yet to drop.

Figure 2 – US 2 YEAR – 10 YEAR TREASURY SPREAD (%)

Past performance is not a guide to future performance.

Source: Bloomberg, 10 July 2023. Shaded Areas indicate recessions.

The rational trade

For the first time in 15 years savers are offered an acceptable risk-free rate. We can certainly see the appeal of short-dated U.K. government bonds yielding over 5% in the short term, although we are steering clear of corporate debt because credit spreads tend to widen in a downturn. Short-term yields today are at their most attractive relative to the earnings yields on equities since 2000 or 2007 – neither were great times to buy stocks. Short-dated bonds are liquid and provide flexibility for our asset allocation purposes, giving us dry powder.

In the longer term, we look to increase exposure to real assets, not nominal ones. We have the flexibility and the proven ability to asset allocate. In times of distress, as in 2008 and again in 2020, we have lent in and been prepared to take more risk, materially increasing exposure to equities (see Figures 3 & 4). However, when it comes to positioning the portfolio cautiously in advance of an expected downturn, it is essential that we are early rather than late. This is how we succeeded in protecting capital in 2001-2, 2007-9 and in 2020. We never want to be selling into a falling market. That is when we need to be buying. We feel strongly that strategic asset allocation will once more come to the fore. Combined with a bias towards the shares of better-quality companies, this has driven our long-term returns to-date. And we are ready to act when the opportunities present themselves.

In this context, we were recently asked about the attractions of a one-year fixed deposit. However seductive the interest rate offered, we do not think that tying up capital just now holds much appeal. In current conditions one should retain as much flexibility as possible. Today there is a likelihood that asset prices predicated on zero rates will be repriced to pre-financial crisis levels. The good news is that investors are being paid to wait.

We hope you have a restful and enjoyable summer.

Figure 3 – TROY MULTI-ASSET STRATEGY DYNAMIC ASSET ALLOCATION DURING THE COVID-19 MARKET SELL-OFF – DECEMBER 2019 TO MARCH 2020

Past performance is not a guide to future performance.

Source: Troy Asset Management, 30 June 2023. *Gold related investments include two ETCs and Franco Nevada. **Liquidity includes UK T-Bills and cash

Figure 4 – DYNAMIC ASSET ALLOCATION, CUMULATIVE PERFORMANCE (%), ACTUAL VS STATIC PORTFOLIO

Past performance is not a guide to future performance.

Source: Troy Asset Management, 31 December 2019 to 30 June 2023. *Performance based on a representative mandate of Troy’s multi-asset strategy. Static portfolio return represents the simulated performance assuming the weight allocation of the mandate were held constant from the start date of the period under review, and rebalanced on a monthly basis back to the original weight allocation as at 31 January 2020. This date was selected as a representation of the asset allocation prior to significant dynamic asset allocation decisions across the portfolio, following the onset of Covid-19. Cumulative performance is shown gross of fees in GBP.

1An echo bubble is a post-bubble market rally that results in another, smaller bubble. Echo bubbles were first identified in economic experiments and have since been documented in several historic market bubbles. The echo bubble occurs in the sector or market in which the preceding bubble was most prominent.

Disclaimer

All information in this document is correct as at 21 July 2023 unless stated otherwise.

Please refer to Troy’s Glossary of Investment terms here. The document has been provided for information purposes only. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. The document does not have regard to the investment objectives, financial situation or particular needs of any particular person. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The views expressed reflect the views of Troy Asset Management Limited at the date of this document; however, the views are not guarantees, should not be relied upon and may be subject to change without notice. No warranty is given as to the accuracy or completeness of the information included or provided by a third party in this document. Third party data may belong to a third party.

Past performance is not a guide to future performance. All references to benchmarks are for comparative purposes only. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The investment policy and process of the may not be suitable for all investors. Tax legislation and the levels of relief from taxation can change at any time. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Issued by Troy Asset Management Limited (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. © Troy Asset Management Limited 2023