Inflation in tricky markets

Markets in 2022 certainly feel very different from 2021. Investors have woken to the prospect of rising interest rates and tighter financial conditions, driven by higher inflation, and are adjusting their requirements for returns accordingly.

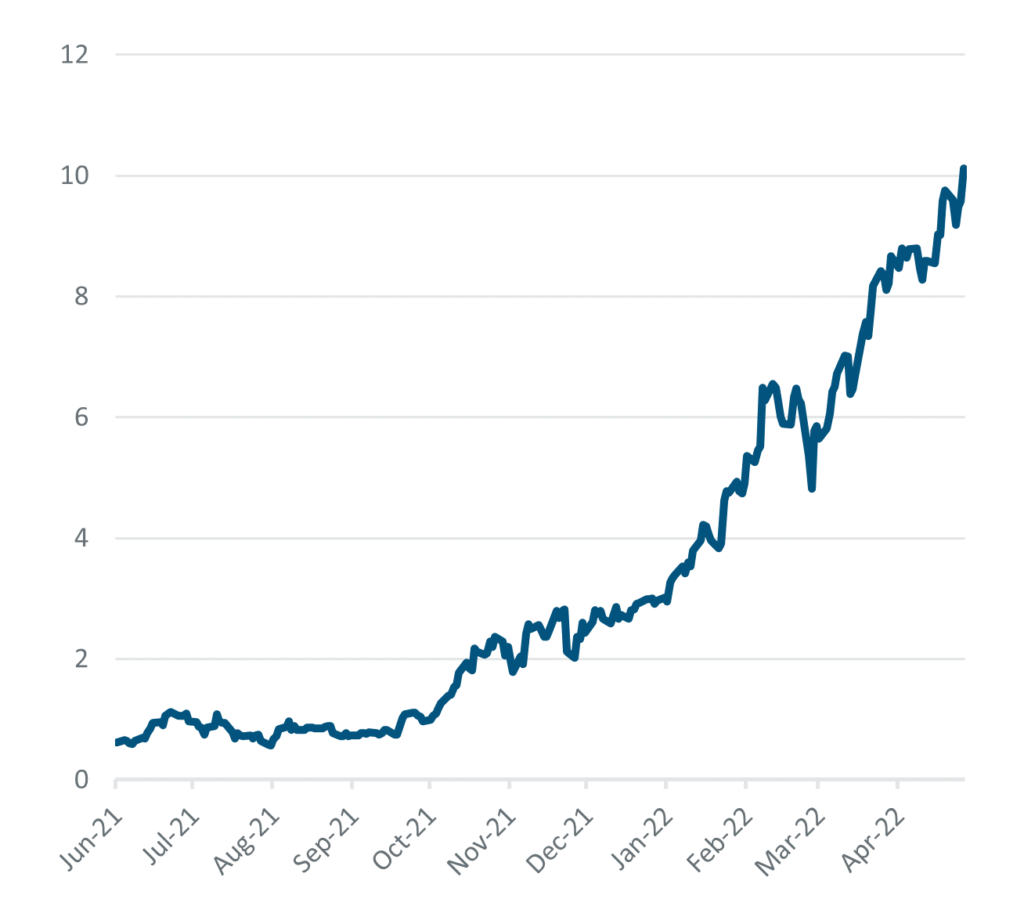

With hindsight, it seems clear that central bankers and investors were overly complacent. Whether markets have yet repriced adequately (or even overshot) is anyone’s guess, but the moves have been material. As Chart 1 below highlights, the market is currently pricing in more than 10 rate hikes in the US this year, having expected barely a single rise in 2022 last year.

Chart 1: Expected number of =0.25% US rate hikes before December 2022

As a case in point, the tech-heavy US NASDAQ index, which tends to house higher growth, higher valued companies, has fallen ~22% to the end of April (even further in May), whilst the MSCI Oil & Gas Index has risen ~27%. This c.50% divergence over 4 months is a stark example of the dispersion of returns across markets. Your Fund avoids both the low/no growth and the high growth/speculative end of the spectrum. As managers, we seek resilient cash flows, growing dividends and reasonable valuations, which we hope will protect investors from extreme outcomes. Our challenge so far this year is our reluctance to invest in oil or mining shares, because these businesses are so volatile and commoditised. This usually serves us well, but it currently means we are forgoing returns from the recent rally in commodities that others are enjoying.

The immediate consequence of this repricing has been two-fold; firstly, those securities that are perceived to most immediately benefit from inflation or higher rates have performed well, notably commodity stocks. Secondly, assets with a ‘longer duration’ or fixed coupons have performed poorly. To that end, bonds have failed to provide a safe haven, while so-called ‘higher growth’ equities have also fallen significantly.

Our contributors and detractors

After a strong 2021 in which your Fund delivered a total return of +15.6%, 2022 has seen a partial reversal. At the end of April, the value of your Fund had fallen by c.6.3%. Returns across the FTSE All-Share have been widely dispersed; and the same is true across the portfolio. Table 1 below shows the top and bottom 5 contributors to returns to the end of April, as well as their share price returns.

Table 1

| Top 5 Contributors YTD | Return (%) | CTR (%) |

| AstraZeneca | +25.2 | +0.6 |

| GlaxoSmithKline | +13.6 | +0.5 |

| British American Tobacco | +24.7 | +0.3 |

| National Grid | +12.7 | +0.3 |

| InterContinental Hotels Group | +9.6 | +0.2 |

| Bottom 5 Contributors YTD | Return (%) | CTR (%) |

| Experian | -22.9 | -1.5 |

| Croda International | -22.9 | -1.1 |

| Fever-Tree | -31.0 | -0.7 |

| IntegraFin | -35.7 | -0.7 |

| Domino’s Pizza | -22.9 | -0.7 |

The share prices of AstraZeneca, GSK, BAT and National Grid have proved resilient, being relatively stable, lowly valued companies. InterContinental Hotels Group continues to recover from the pandemic, helping to drive its share price higher. However, Experian, Croda, Fever-Tree and IntegraFin are higher growth companies relative to the rest of the portfolio and their ratings have compressed for now. Domino’s has also been weak, losing the gains from 2021 as the market worries about UK consumers dealing with the rising cost of living. It is notable that the two biggest detractors to returns, Experian and Croda, were amongst the strongest contributors last year and have delivered exceptional long-term returns. In our view, both have great track records, resilient businesses and strong long-term dividend growth prospects. We have taken the opportunity to add to some holdings on recent weakness and believe the portfolio consists of high-quality, well-researched companies that appear to be increasingly good value.

To avoid any doubt, the Fund’s direct exposure to Russia is insignificant. Troy does not own any Russian stocks and <1.5% of the portfolio’s underlying revenues were derived from Russia and Ukraine last year. This number will be even lower today as companies have withdrawn operations from the former.

YTD returns in context

The Trojan Income’s c.-6% return to the end of April compares unfavourably with the FTSE AllShare total return (the “FTSE All-Share”) of +0.8% and even more so against the FTSE 100. Investors could be forgiven for wondering what is going on. While there are many good things about the UK stock market including leading corporate governance standards, liquidity, hard currency denomination, strong international exposure and a strong dividend culture, one of the unappealing quirks in my opinion is the market

capitalisation-weighted skew of the FTSE AllShare and FTSE 100. There are a few disproportionately large companies that dominate these.

This has long been a feature of the UK market. For example, back in 2000, Vodafone peaked at c.15% of the FTSE 100, meaning its share price return had a disproportionately large impact on the UK market. Since then, unfortunately, Vodafone has been a poor performer, acting as a significant drag on the index. Remarkably, today it accounts for less than 2% of the FTSE 100. We

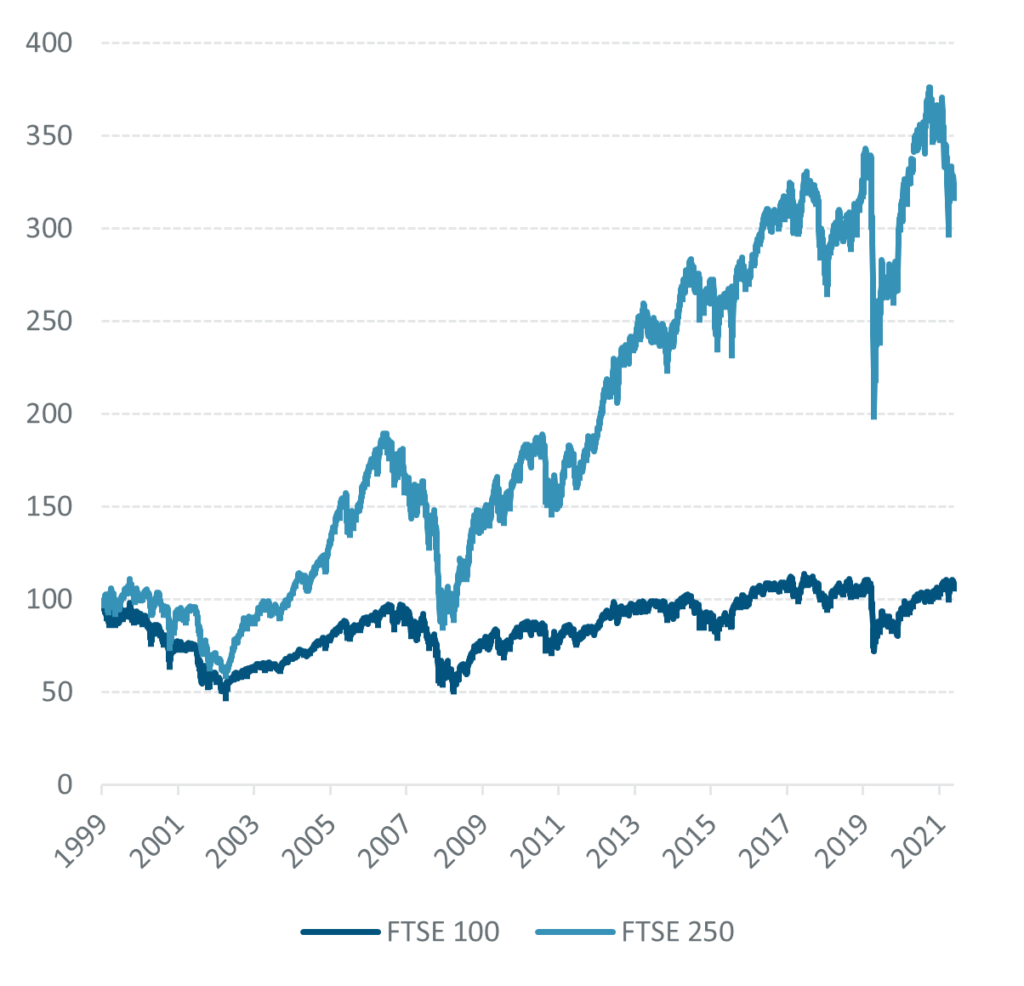

can point to other examples such as HSBC, RBS, BP and Shell. All of these very large companies have delivered poor returns and have collectively weighed down the FTSE 100 to the extent that it has largely tracked sideways in price terms, with the vast majority of returns to investors coming from dividends over the past 20 or so years (see Charts 2 and 3).

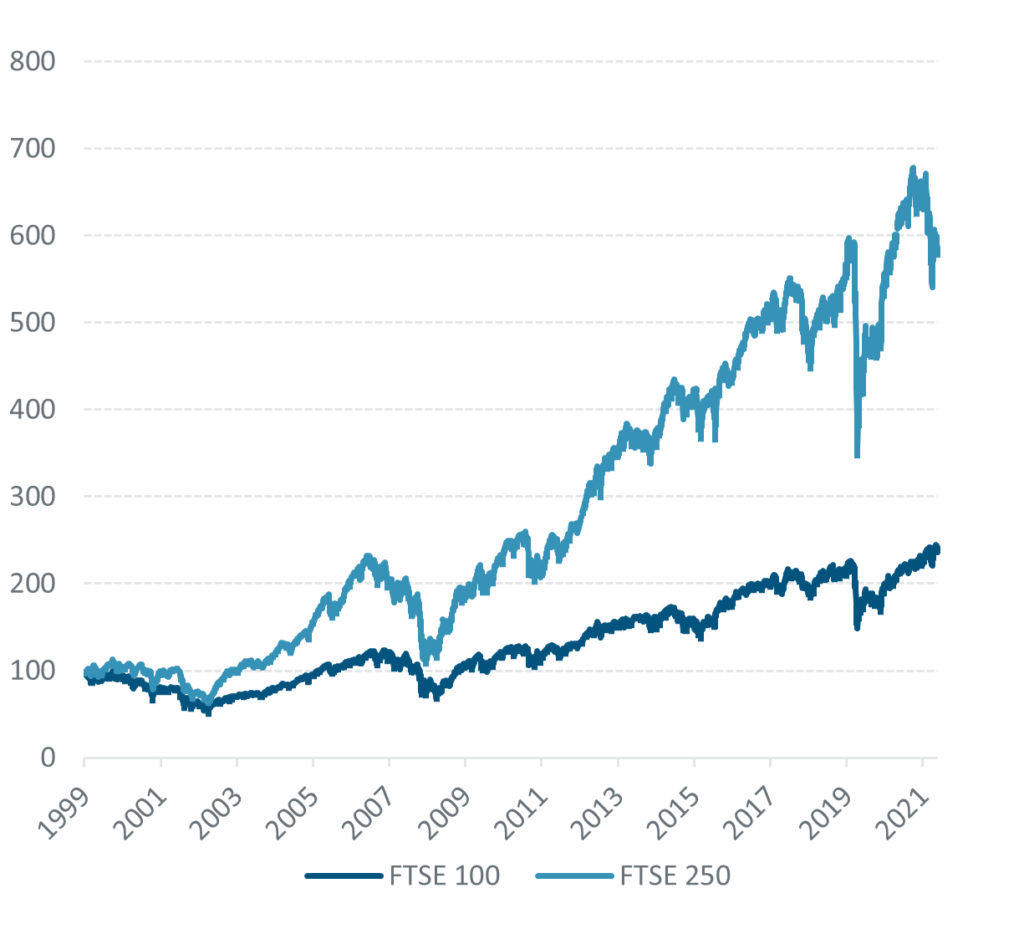

Chart 2: FTSE 100 vs FTSE 250 – price return since 2000 (indexed to 100)

Chart 3: FTSE 100 vs FTSE 250 – total return since 2000 (indexed to 100)

This is in contrast to the FTSE 250 index (the next 250 companies below the FTSE 100) which does not have the same skew, and has managed to deliver share price returns of 200% as well as healthy dividends (see Charts 2 and 3).

Today, while no single stock has the weighting that Vodafone had back in 2000, the FTSE 100 remains particularly sensitive to a few companies. Many of these are in sectors we do not invest in, due to their cyclicality, capital intensity and low return on invested capital, for example oil and mining companies and banks. Together, these account for over 30% of the FTSE 100. These sectors’ outperformance tends to be highly sporadic while dividends are volatile in both directions. As unashamedly active investors who steer clear of the most cyclical and capital-intensive parts of the UK market, our returns can be materially different from the Fund’s index, often to our advantage, but sometimes not, as is the case currently.

The top-heavy nature of the UK market also makes it difficult to compare with other markets or indexes. This is particularly true when commodity prices are as volatile as now.

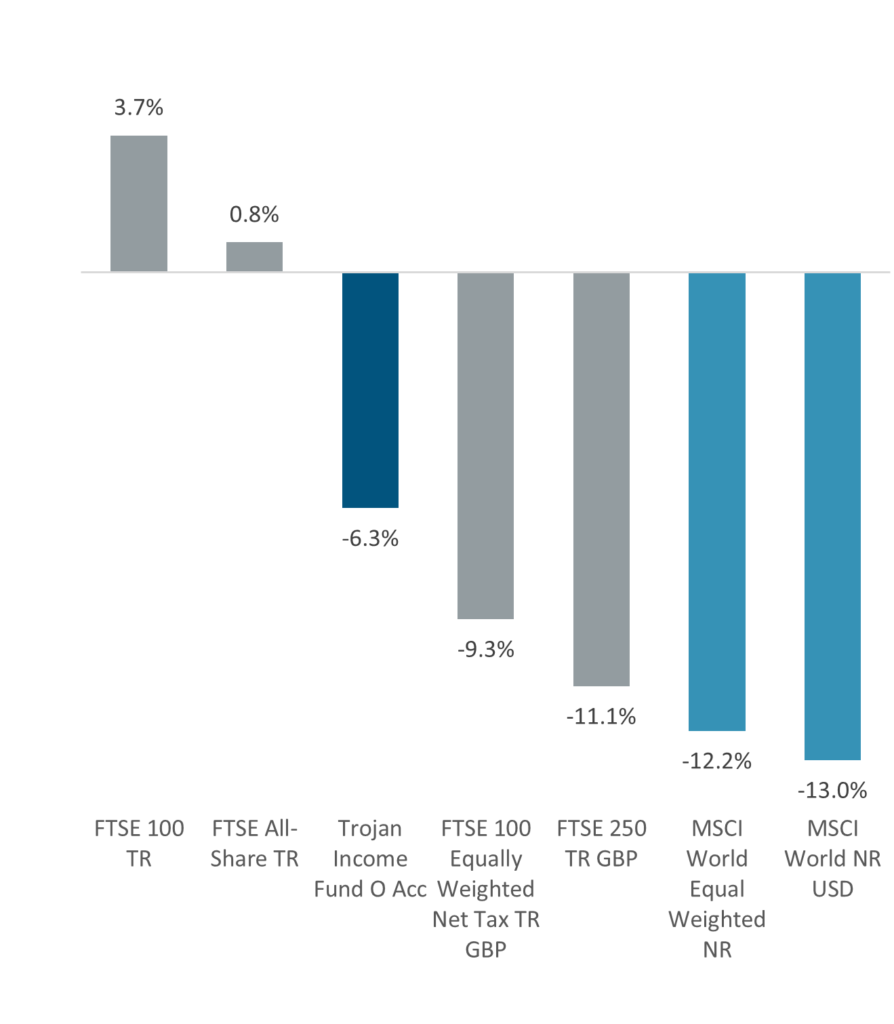

Chart 4 below illustrates this point well. It provides context around UK indices’ returns, comparing them with the returns from other

markets and the Trojan Income Fund.

Chart 4: Trojan Income Fund vs FTSE and MSCI indices YTD (local)

We observe the following;

i) the FTSE 100/All-Share is the standout performer year to date, outperforming by far the FTSE 250 and global indexes in

local currency terms. Their returns are at odds with everything else.

ii) comparing the FTSE 100 to the FTSE 100 equally weighted index1 highlights the skew within the UK market and explains

why the FTSE 100 has delivered standout returns so far this year. The 13-percentage point spread between the FTSE 100 and its equally weighted index equivalent is staggeringly wide and is caused by a few large companies performing extremely well compared to the median UK company year to date.

iii) the Trojan Income Fund’s return looks disappointing in comparison with the FTSE 100 or FTSE All-Share (which is dominated by the FTSE 100) over this short period. However, compared to the FTSE 100 equally weighted index, the FTSE 250, or the MSCI World Index in USD, the Fund has been far more defensive.

iv) this skew that is impacting the FTSE 100 and FTSE All-Share simply does not exist for global managers, evidenced by the 1 The FTSE 100 is a market cap weighted index, whereas the FTSE 100 equally weighted index equalises the size of each company so that each of the 100 companies are essentially equally weighted in the index at 1% tight spread between the MSCI World and MSCI World Equally weighted index.

Table 2 shows the five stocks which have been the biggest contributors to the FTSE 100’s returns so far this year, and their size, highlighting how well some of these mega-caps have performed versus most companies.

Table 2

| Top 5 Contributors to the FTSE 100’s returns YTD | Market Cap | Total Return |

| Royal Dutch Shell | £163bn | +35% |

| AstraZeneca | £165bn | +25% |

| Glencore | £65bn | +35% |

| British American Tobacco | £76bn | +26% |

| HSBC | £100bn | +15% |

The average market cap of these five companies is £114bn and the average return YTD is c.+29%. For context, this compares to the median FTSE 100 company which has a market cap of only £8bn and has returned c.-9%.

A quick glance at the UK fund league tables YTD shows FTSE 100 tracker funds dominating active funds, as few active funds have such as high a weighting in these large index constituents. Not surprisingly, you also find those income funds that seek to track the yield of the index outperforming as well. Since it is these same large, high yielding companies that dominate UK dividends, many income funds own these companies in good size, whereas we do not. However, opting for a FTSE tracker may not prove a winning strategy over the long term. In fact, we expect the opposite. While the likes of BP and Shell may be leading the UK market up today, our guess is their combined c.12% weighting will drift down in favour of faster growing and higher quality UK businesses in the

future.

To sum up, as unwelcome as poor relative returns are, we will continue to invest in the way we long have; investing only in high quality, resilient businesses that we believe can grow their dividends over the long term. We have been in similar situations before, and firmly believe that in the long run, our quality income approach will win.

Prioritising resilient cash flows, reasonable valuations

“Be the best doctor in town and you will be protected from inflation”

Warren Buffett (2022)

We are currently in the eye of the inflation storm. The UK, US and EU continue to publish the highest CPI figures in almost three decades and central banks are in the early stages of raising rates in the face of potential slowing demand. There is a growing chance of economic weakness both at home and abroad, whilst factors such as the European energy crisis and disruptions in the supply of goods and services mean inflation is likely to remain heightened for some time yet. In this environment, more than ever, we are prioritising resilient cash flows and reasonable valuations.

As the Warren Buffett quote above implies, if you are a company with the best quality products, save customers time and money and provide critical products and services, you will have a good chance of pricing for inflation and protecting earnings power. The high-quality businesses we favour enjoy these attributes, which has enabled them to earn high margins and produce recurring cash flows and dividends.

If those with the least resilient cash flows are at risk, so are those with the least valuation support. One of the many benefits of a dividend centred approach is we avoid the most speculative growth companies that trade on the highest multiples. These tend to consume cashflow and so are unlikely to pay sustainable 7 dividends. Over the past decade, loose financial liquidity has provided a rising tide for valuations, lifting most boats. In an environment of rising discount rates, greater emphasis is required on what one pays for growth. For us, that does not mean gravitating towards stocks with the lowest ‘PEs’2 and highest yields. If fantastic businesses existed for those prices, then our job would be easy, but this simply is not the case. Markets are competitive and the lowest ratings or highest yields tend to be reserved for those businesses with poor prospects. One might do well from sectors such as energy and mining whilst rate expectations shift or when commodity prices spike. But ultimately to sustain outperformance requires consistent value creation and growth. It is therefore a combination of high-quality economics, sustainable growth and reasonable valuations that we believe will provide both short-term resilience and underpin strong shareholder returns in the future.

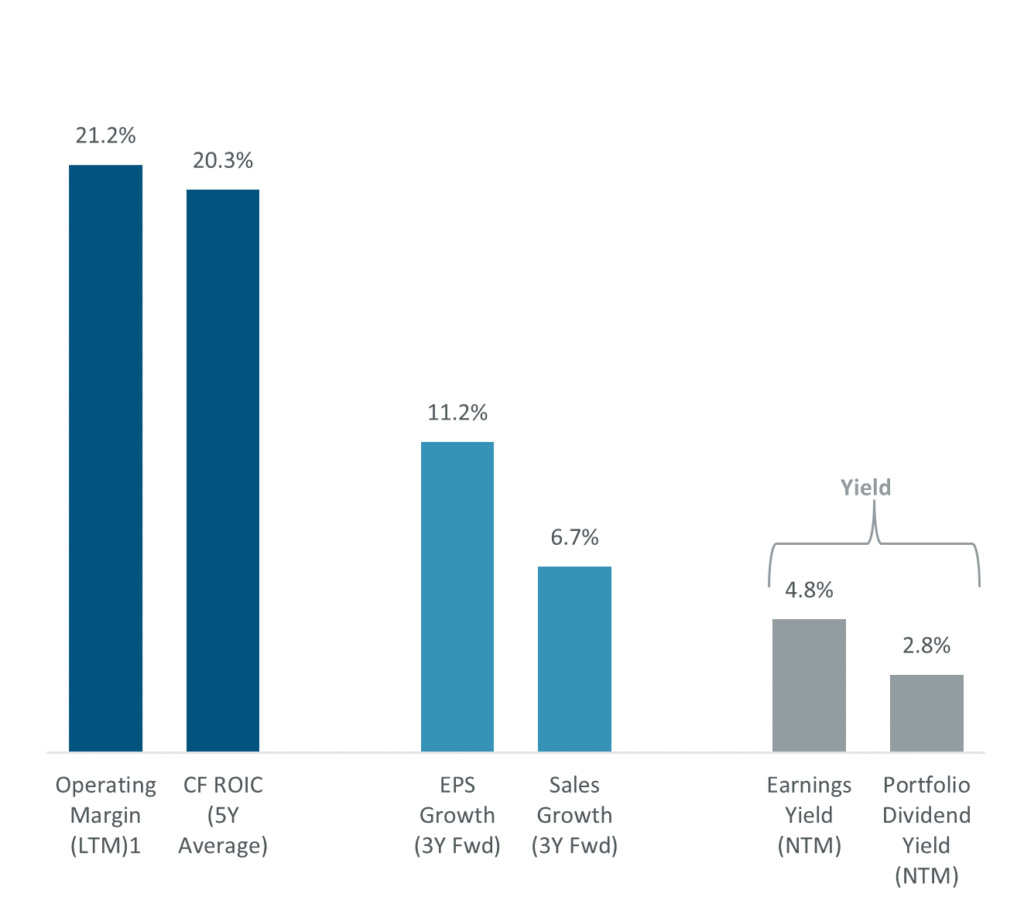

Chart 5: Trojan Income Fund – quality, growth, and reasonable valuation

As highlighted in Chart 5, in aggregate, the portfolio’s underlying holdings have good operating margins, generate high returns on

capital and continue to grow at a healthy rate. With regards to valuation, the Fund currently trades with an approximate 5% forward earnings yield which supports a c.3%3 prospective dividend yield. This strikes us as reasonable, particularly given the quality and growth potential we see of the companies the Fund holds. In volatile markets such as these, the Fund’s dividend can provide reliable income or capital to reinvest into lower prices. In a rising rate environment, these yields could go higher (and valuations could go lower). But taking a longer-term perspective, this combination of a resilient earnings coupon today, derived from a collection of fantastic companies that can grow long into the future, will, we believe, translate to compounding income and capital returns for

investors.

We wish our investors good health in these turbulent times. As ever, feel free to get in touch with any questions.

Blake Hutchins

Disclaimer

All information in this document is correct as at 30 April 2022 unless stated otherwise. Please refer to Troy’s Glossary of Investment terms here .Past performance is not a guide to future performance. Forecasts are not a reliable indicator of future performance. The document has been provided for information purposes only. Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. The document does not have regard to the investment objectives, financial situation or particular needs of any particular person. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The views expressed reflect the views of Troy Asset Management Limited at the date of this document; however, the views are not guarantees, should not be relied upon and may be subject to change without notice. No warranty is given as to the accuracy or completeness of the information included or provided by a third party in this document. Third party data may belong to a third party. Benchmarks are used for comparative purposes only.

Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. Any decision to invest should be based on information contained in the prospectus, the relevant key investor information document and the latest report and accounts. The investment policy and process of the fund(s) may not be suitable for all investors. If you are in any doubt about whether the fund(s) is/are suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Asset allocation and holdings within the fund may be subject to change. Investments in emerging markets are higher risk and potentially more volatile than those in developed markets.

The fund(s) of Trojan Investment Funds are registered for distribution to the public in the UK but not in any other jurisdiction.

The distribution of shares of sub-funds of Trojan Investment Fund (“Shares”) in Switzerland is made exclusively to, and directed at, qualified investors (“Qualified Investors”), as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended, and its implementing ordinance. Qualified Investors can obtain the prospectus, the key investor information documents, or as the case may be the key information documents for Switzerland, the instrument of incorporation, the latest annual and semi-annual report, and further information free of charge from the representative in Switzerland: Carnegie Fund Services S.A., 11, rue du Général-Dufour, CH-1204 Geneva, Switzerland, web: www.carnegie-fund-services.ch. The Swiss paying agent is: Banque Cantonale de Genève, 17, quai de l’Ile, CH-1204 Geneva, Switzerland.

In Singapore, the offer or invitation to subscribe for or purchase Shares is an exempt offer made only: (i) to “institutional investors” pursuant to Section 304 of the Securities and Futures Act, Chapter 289 of Singapore (the “Act”), (ii) to “relevant persons” pursuant to Section 305(1) of the Act, (iii) to persons who meet the requirements of an offer made pursuant to Section 305(2) of the Act, or (iv) pursuant to, and in accordance with the conditions of, other applicable exemption provisions of the Act. This document may not be provided to any other person in Singapore.

All references to indices are for comparative purposes only. All reference to FTSE indices or data used in this presentation is © FTSE International Limited (“FTSE”) 2022. ‘FTSE ®’ is a trade mark of the London Stock Exchange Group companies and is used by FTSE under licence.

Issued by Troy Asset Management Limited, 33 Davies Street, London W1K 4BP (registered in England & Wales No. 3930846). Registered office: Hill House, 1 Little New Street, London EC4A 3TR. Authorised and regulated by the Financial Conduct Authority (FRN: 195764).

Copyright Troy Asset Management Ltd 2022